Article contributed by Ren & Heinrich

Follow them on Medium

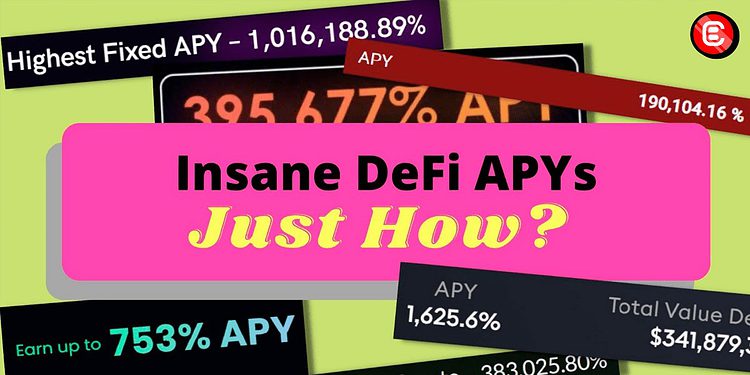

How On Earth Can Some DeFi Platforms Offer Users Annual Percentage Yields Of 100,000% And More? An Explanation.

If you are in the crypto space, you surely have already seen examples of some DeFi projects promising unbelievably high APYs (Annual Percentage Yield) of multiple 100,000% or even more.

And maybe you’ve asked yourself ‘How do they do that and how on earth is this sustainable?’

Careful, it’s a trap. Here’s what you need to know.

How High APYs Are Produced

There are a lot of DeFi projects and the teams behind them want to — naturally — earn money with them. Tokens play a vital role in this as they are a main tool for the developers to generate an income. That’s why they want their token to be bought. For this, they partner with a DEX (decentralized exchange).

There are 4 ways how a DeFi project can generate demand for their token and these methods are also used to generate high APYs.

- The DeFi project creates a liquidity pool. A liquidity pool is a place where token holders can lend their tokens to others, so there is always a supply of tokens available on the DEX. In return, token holders receive a proportional percentage of the fees from all transactions made. The token owners can therefore help the crypto exchanges to obtain liquidity and thus earn money or tokens.

- To push APY higher, many DeFi projects cooperate with a DEX to create a farm. Liquidity providers stake their token in the farm to earn the DEX’s native token in return.

- Some projects also open a pool on the DEX. Users can stake the native DEX token and earn the DeFi project tokens.

- Because many DeFi project tokens are pretty much worthless, the project owners can give out insane amounts of them as a reward for holding them. Think about it. If you have minted some 50 billion tokens you surely can give out hundreds of thousands or even millions here and there to attract users.

All of this makes it possible to generate very high APYs (at the beginning).

Blah, blah, blah — don’t fall for this crap.

How The Money Train Stops

However, there are 4 major risks or reasons why high APYs don’t last very long.

High APYs are paid out in tokens.

Due to insane APYs, and because they have generated them out of nothing, the developers are paying out massive amounts of project tokens to holders. This inflates the number of tokens people hold and in turn depreciates the token’s price.

That’s why the initial sale of DeFi project tokens often has a very low supply of a few 100k with an attractive token price of several $. People see the token price and the promised APY and think that by investing 1000$ in one year they’ll be a millionaire.

It’s a trap.

But what they often don’t tell you is that the total token supply is actually in the billions. And as millions of tokens are paid out to cover the interest, the price falls, and falls, and falls. This process is also called dilution.

The more people participate, the lower the rewards.

Farms and pools offer token rewards per block which are divided up among stakers. But as more people join in, the payouts for each person get lower. This reduces APY.

100,000,000 x $0 = $0

Most crypto projects fail. That is normal and there are numerous reasons for this: They lose traction, fall behind competitors, fail to innovate, etc. As a consequence, users abandon a project to put their money into the next one. Taken together with the reasons mentioned above, the price of the project token goes down. Even a 300k% APY on a worthless token is worth … nothing.

Details matter.

The classic rug pull.

In the worst case, the project developers remove their liquidity from the pool, swap all of their project tokens for other high-value tokens or cryptocurrencies, and simply walk away. Investors are left with a useless and worthless token.

WhaleFarm token crashed 99% in a $2.3 million rug pull.

Final Thoughts

As I laid out in this article, it is very important for you to not trust when someone promises high returns.

Also, some of these projects use every trick in the book to get money from unsuspecting investors.

- They give their protocols and features fancy names.

- They pay for the publication in well-known media.

- This also includes the close cooperation with influencers on social media who present the project as something serious.

Influencers making deals with a crypto project.

So the next time you see a DeFi crypto project that promises you insane returns, take a moment and consider if they are telling the truth.

Remember: If it’s too good to be true then it’s probably not true.

Article contributed by Ren & Heinrich

Follow them on Medium