I’m selling my LUNA.

Yes, you did read that correctly.

This is not a drill.

And it’s not an easy decision to make.

But that’s life. Sometimes, you’ve got to let go of the ones you love.

TL;DR:

- I remain super bullish on the project.

- I’ve made outsized returns.

- It’s time to recoup capital and diversify.

Before you panic-sell your LUNA holdings, let’s get a few things straight:

Those of you who know me will also know that LUNA has been the best investment I’ve ever made.

First of all, my conviction in LUNA and the Terra ecosystem has never been stronger:

Do I believe that UST will become an industry standard, the leading stablecoin of choice? Yes.

Do I believe that LUNA will therefore continue to appreciate in value? 100%.

So why on earth am I selling?

Well, to understand my predicament, let’s rewind the clock.

Back in 2018, when I was hosting Crypto Trader on CNBC, we went to South Korea to check out the local crypto scene.

And while I was out there, I met two very smart guys at the Hashed Accelerator – Daniel Shin, and Do Kwon.

In hindsight, I actually met two geniuses.

Anyway, I was so impressed by their vision for a family of algorithmic stablecoins that I became an early investor at the IDO stage.

And it wasn’t the only time I invested.

This screenshot is from a conversation I had in July 2020, when LUNA was actually cheaper (26 cents) than the IDO price.

And yes, I bought more… loads more.

My friend didn’t.

Today, he’s miserable!

Anyway, for ages, LUNA did nothing.

But I diligently staked my tokens on TerraStation, earned airdrops, and waited.

The rest, as they say, is history. And I made more outsized returns on LUNA than any other investment of my life.

Today, I still believe LUNA is one of the most promising tokens in the entire space, with plenty more upside potential.

However, the time has come to part with most of my holdings.

Here’s why:

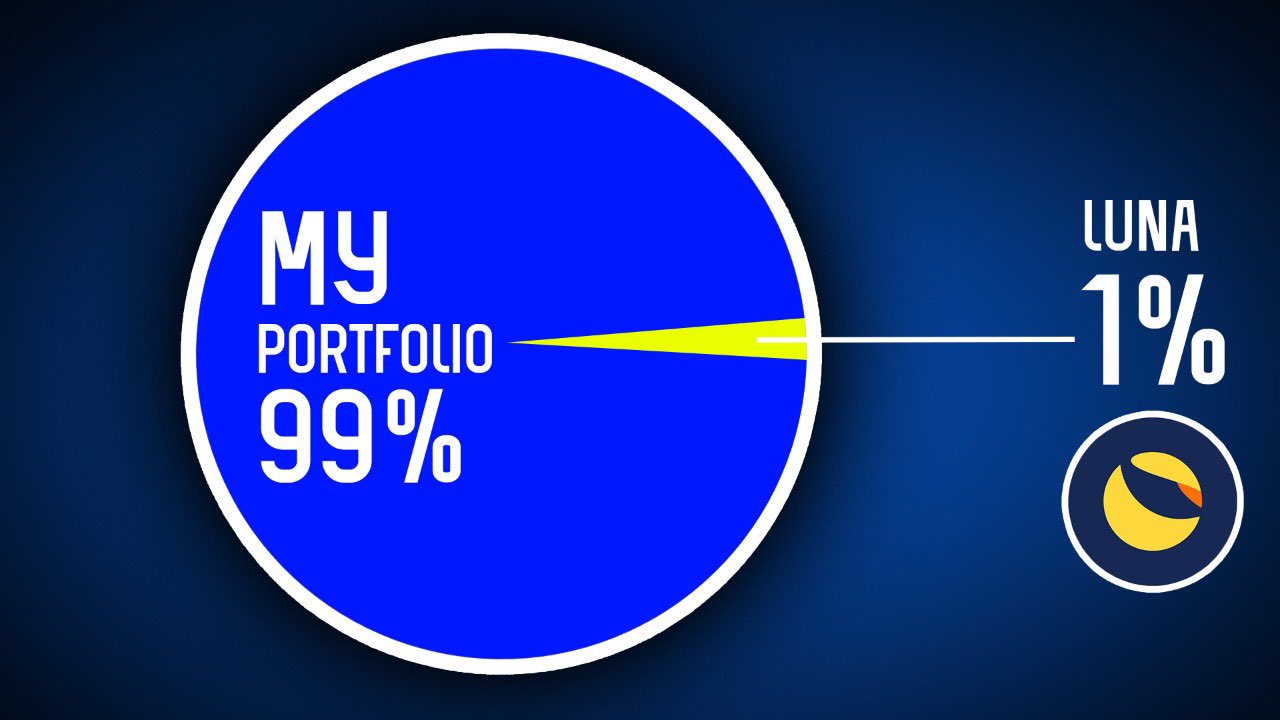

When I first invested in LUNA, it represented about 1% of my portfolio.

Today, it has become by far my largest holding, accounting for over 60% of my portfolio.

I’ve spoken extensively about LUNA and UST’s resilience. And although I am highly confident in the project’s staying power, I have to be pragmatic.

Even if there is only a slim chance that something goes wrong on the protocol (UST loses its peg, or Do Kwon goes AWOL), do I want to have 60% of my crypto position in a single token?

Amazing as the project may be, this simply isn’t pragmatic.

I’ve made huge returns. Now, it’s time to strategically diversify.

Over the next 12 months, I will be selling at least 25% of my LUNA holdings and redeploying into the following tokens:

- Bitcoin

- Ether

- Sol

- Rune

- Avax

- Arweave

Why these and not some low-cap degen plays?

Because what I don’t want to do is change the risk profile of my portfolio.

Confident as I am in LUNA, I don’t want to take the risk of something happening to my favorite token.

This is why I’ll be spreading some of my profits across a range of strong projects.

Don’t get me wrong, I’ll take no pleasure in doing it (and not just because of the tax implications), because if you asked me which major project I’m most excited about, it’s still LUNA.

If you know me, you’ll know I’m a risk-taker – it’s in my DNA. But even I don’t want to take the risk of having 60% of my portfolio in one protocol, no matter how strong it might be.

It’s not every day that I say this, but now’s the time to do the responsible thing!