The world's biggest live crypto network delivering news, analysis, and education in real time.

STREAMING CHANNELS

MEET THE TEAM

Fefe Demeny | Partner, Crypto Banter

Fefe

Fefe Demeny is a crypto entrepreneur and show-host who turned early Bitcoin into a mission: empowering traders and investors through smart, fun market analysis and a relentless hustle mindset.

Top Crypto Masterclasses

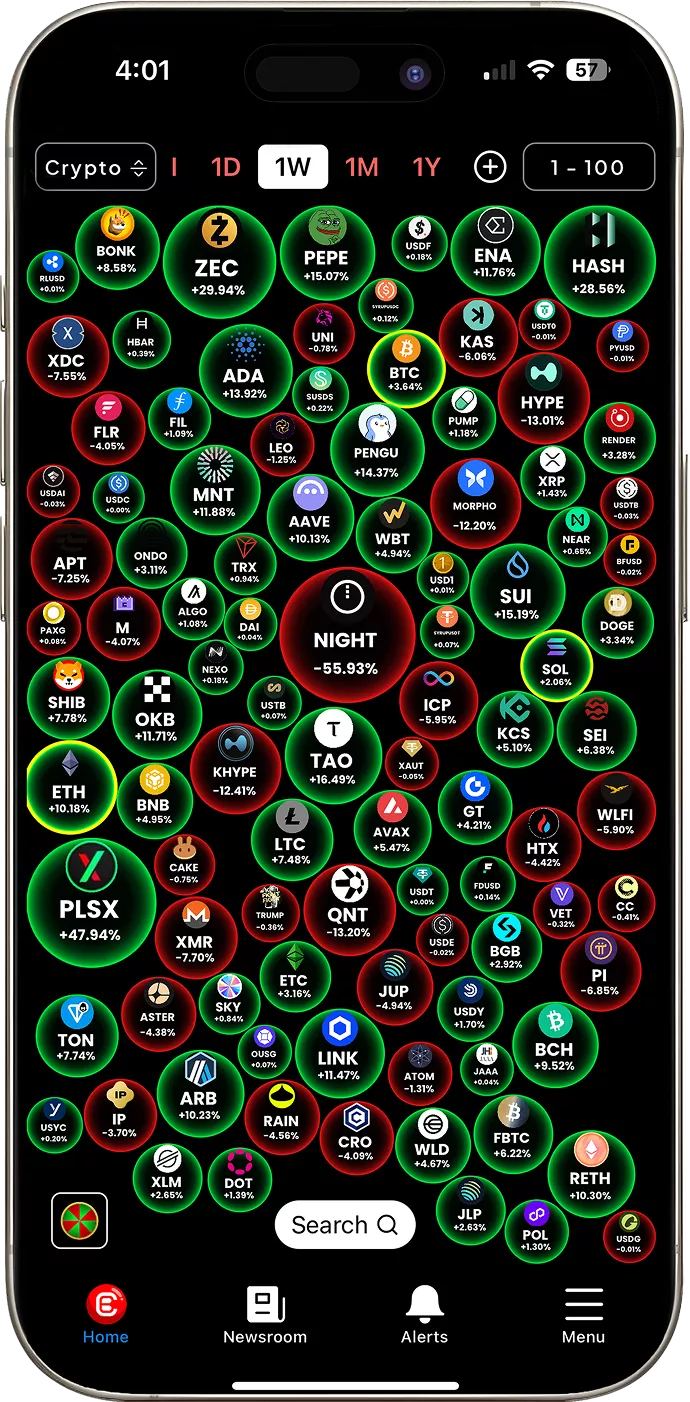

BANTER BUBBLES

Where Crypto Comes Alive

Banter Bubbles turns the entire crypto market into an interactive bubble map. Watch bubbles pump, join token-specific chats, and react faster with a visual platform designed for traders who thrive on real-time information.

247 Crypto

Trade the News Before It Goes Viral

By the time breaking news hits X, tokens have already pumped 50-200%. 247 Terminal delivers market-moving news instantly and lets you execute trades before retail traders even see the headline.